OPEC output hikes, trade wars have US oil producers wary of 'drill baby drill'

- by Brighton, Washington, RNG247

- about 6 months ago

- 135 views

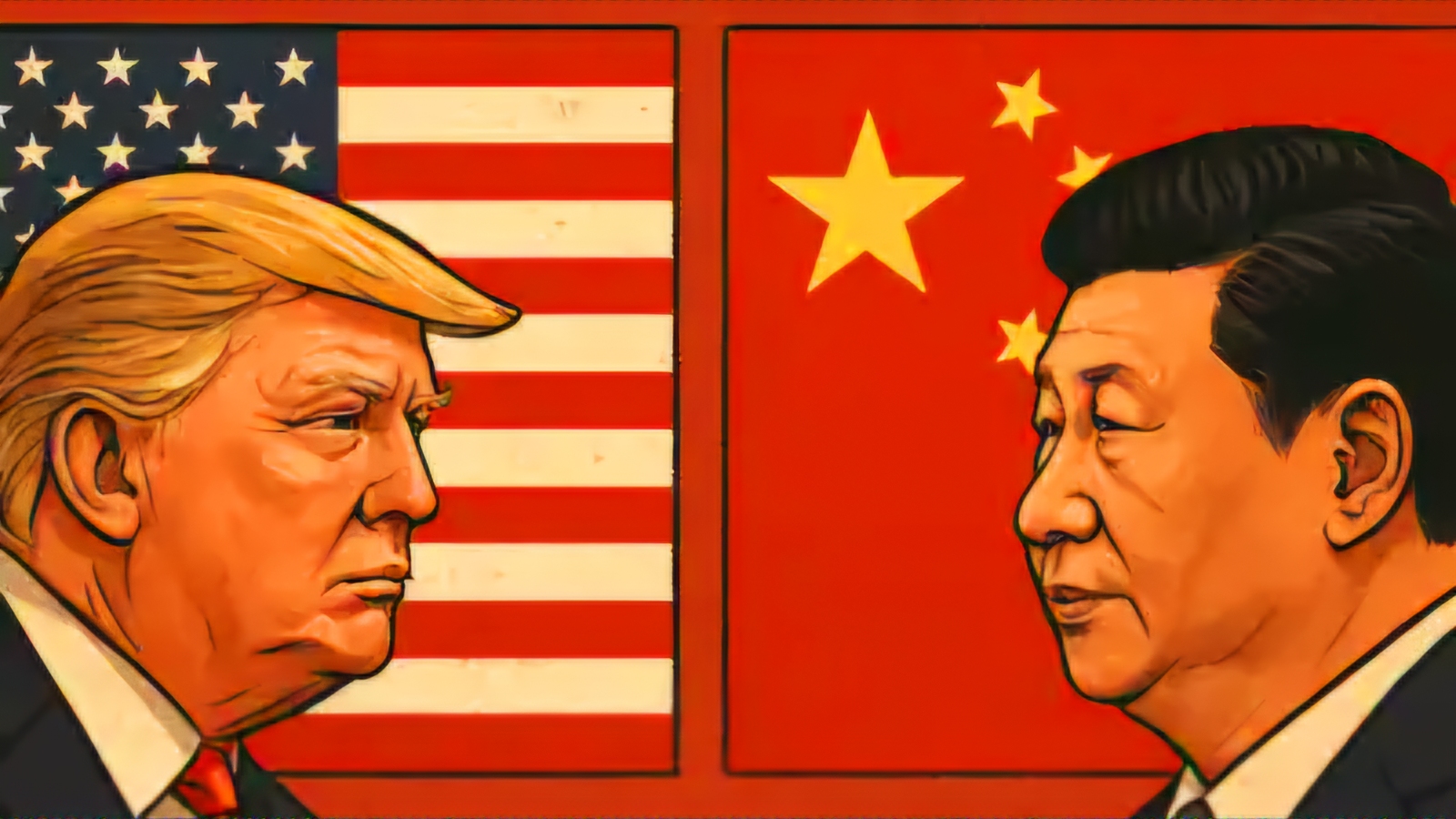

As the price of oil plummets to $55 a barrel, down significantly from $78 at the start of the Trump administration, U.S. oil producers are bracing for a challenging future. The double-edged sword of rising crude production from OPEC and fluctuating trade tariffs has put the once-resilient American oil sector on high alert, prompting many to reconsider the administration's bold "drill baby drill" narrative.

The United States has solidified its status as the world’s leading oil producer, with output reaching approximately 13.55 million barrels per day. This production supports millions of jobs and generates trillions of dollars annually. Since his first day in office, President Trump has been an advocate for increased oil production, aiming to simplify regulations for companies eager to expand their output. However, this positive initiative now appears overshadowed by a new set of economic realities.

Price Pressures Prompt Serious Concerns

The sharp decline in oil prices has rattled the market. Many oil companies assert that production becomes unprofitable below the crucial benchmark of $65 a barrel. This sentiment has only been exacerbated by recent tariffs that increase the costs of steel and essential drilling equipment, thereby posing a further threat to the industry's viability.

The market turmoil intensified on April 2 when President Trump announced tariffs on various trading partners, sending oil prices into a downward spiral. In a striking response, OPEC and its allies, collectively known as OPEC+, announced plans to increase their output, adding pressure to U.S. prices. Analysts noted that the U.S. Energy Information Administration (EIA) has significantly lowered its price forecasts, predicting an average of $63.88 per barrel for 2025, down from $70.68.

The landscape is shifting, with global oil demand predictions reduced to 0.9 million barrels per day—0.4 million fewer than previous forecasts. These adjustments indicate a potential tightening of production and investment in U.S. oilfields.

A Shift from Expansion to Caution

Top industry players, including Chevron and SLB, have already begun implementing layoffs and cost-cutting measures in response to the faltering oil prices. "If prices stay below $60, we will undeniably see a reduction in the number of drilling rigs operational in the U.S.," says Roe Patterson, managing partner at Marauder Capital. He emphasized the current environment has unwittingly paved the way for OPEC nations to reclaim market share in the U.S. market.

The U.S. oil rig count was reported at 506 at the end of March, a stark decline from its 2018 peak of 882. Industry experts warn that if prices remain in the $50 range, rig counts could plummet by more than 20%, with some projections suggesting up to a 50% drop in extreme cases.

Evaluating Profitability Amid Rising Costs

Many producers require an average price of $65 per barrel to maintain profitability, according to a Dallas Federal Reserve survey. While costs can dip below $50 per barrel in optimal conditions, break-even prices escalate with the addition of dividends and corporate expenses, reinforcing the belief that profitability is slipping out of reach.

Operating under tightened budgets, energy companies have shifted focus towards capital discipline and shareholder returns over aggressive growth strategies. "Even those with lower break-even points are inclined to slow down activity when prices dip below $65 per barrel," stated Matthew Bernstein, a vice president at Rystad Energy.

In terms of operational expenses, producers face a growing burden. With steel tariffs in place and ongoing fluctuations in costs associated with essential drilling components—often sourced from China—companies are bracing for tighter margins and increased operational strain.

Conclusion: The Future of U.S. Oil Production Remains Uncertain

As the U.S. oil industry grapples with these dual challenges—rising OPEC output and increasing operational costs—its path forward remains uncertain. While innovators have made some efficiency gains, industry leaders recognize that major technological advancements may have plateaued, leaving them facing an uphill battle moving forward.

The ‘drill baby drill’ mentality that once fueled ambitious expansion is now tempered by cautious strategies as U.S. oil producers navigate through these impending economic storms. Only time will tell if the industry can adapt or if it will be forced to contraction amidst a rapidly changing global landscape.

0 Comment(s)